You’re probably tired of watching your paycheck disappear before the next one arrives, wondering where all that money went. The good news? You don’t need a complete financial overhaul to start saving serious cash. With just a few smart tweaks to your daily habits, you can easily put an extra $500 back in your pocket this month. These 35 beginner-friendly strategies will show you exactly how to keep more of your hard-earned money without sacrificing what truly matters to you.

Cancel Unused Subscriptions and Memberships

Everyone has at least one subscription they’ve forgotten about lurking in their monthly expenses. You’re probably paying for streaming services you never watch, gym memberships you haven’t used in months, or apps you downloaded once and forgot. Time to take control and reclaim that money!

Start by checking your bank and credit card statements from the past three months. Look for recurring charges you don’t recognize or use regularly. You can freeze unused memberships instead of canceling them completely if you plan to return later. Many gyms and services offer this option for a small fee.

Don’t forget to downgrade subscription plans for services you use occasionally. That premium tier might be costing you $15 extra monthly when the basic plan works fine. This simple audit could save you $50-150 monthly!

Once you’ve freed up this extra money, consider using a cash envelope system to allocate these savings toward specific goals like building an emergency fund or paying down debt.

Cook Meals at Home Instead of Ordering Takeout

After cutting those sneaky subscription fees, your kitchen offers the biggest opportunity to slash your monthly spending. You’ll save $200-400 monthly by cooking instead of ordering takeout. That’s real money back in your pocket!

Start with batch cooking on Sundays. Cook large portions of rice, pasta, or proteins that’ll last three days. You’ll control ingredients and portions while building your cooking confidence.

Freezer meal prep becomes your secret weapon for busy nights. Prepare casseroles, soups, and marinated meats when you’ve got time. Pop them in your freezer, and you’ll have restaurant-quality meals ready in minutes.

Keep simple ingredients stocked: eggs, pasta, canned beans, and frozen vegetables. These basics create countless meal combinations without breaking your budget or requiring advanced skills.

Try making overnight oats with simple ingredients like rolled oats, milk, and berries for an effortless breakfast that costs pennies compared to café options.

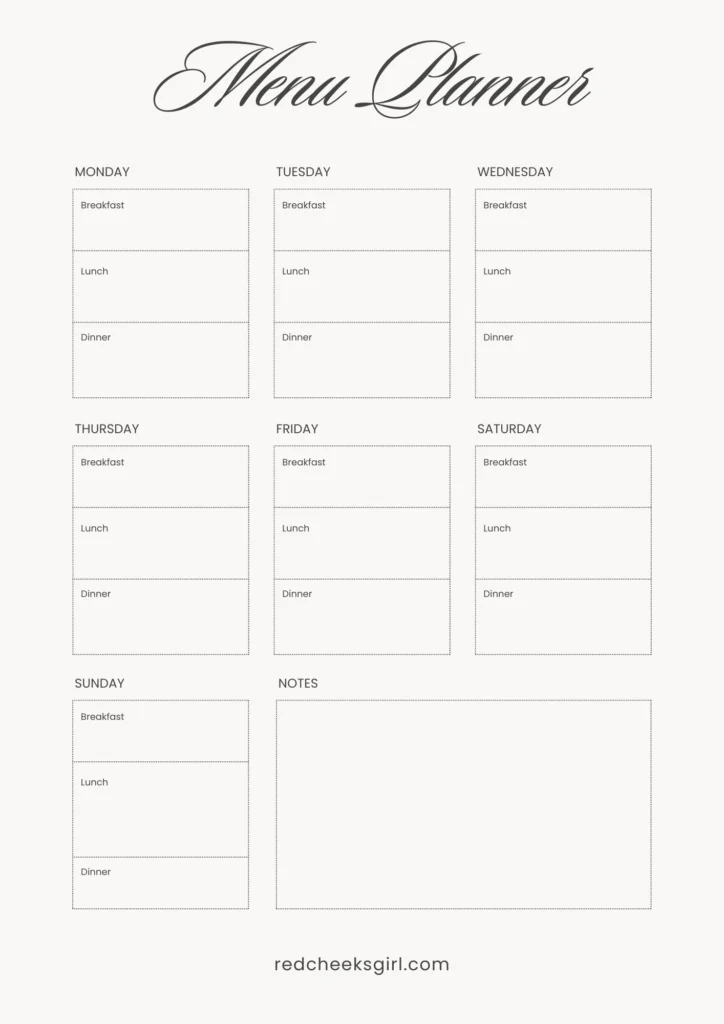

Create a Weekly Meal Plan and Shopping List

When you plan your meals before shopping, you’ll cut your grocery bill by 25-30% and eliminate those expensive last-minute store runs. You’ll take control of your spending and stop wasting money on impulse purchases.

Start by checking what’s already in your pantry and fridge. Then plan seven days of breakfast, lunch, and dinner around those ingredients. Write everything down – this becomes your roadmap to success.

Create your shopping list based on your meal plan. Organize it by store sections like produce, dairy, and meat. This keeps you focused and speeds up your shopping trip.

Consider meal prepping on Sundays. Spend two hours doing batch cooking for the week ahead. You’ll save time and money while gaining complete control over your food budget!

Just like establishing a morning routine helps reduce stress and improves focus throughout the day, having a consistent meal planning schedule creates structure that reduces decision fatigue and financial stress.

Buy Generic Brands at the Grocery Store

Generic brands can slash your grocery bill by 20-40% compared to name-brand products, and you’ll barely notice the difference in quality. You’re fundamentally paying for fancy packaging and marketing when you choose name brands over store alternatives.

Start by testing generic versions of staples like pasta, rice, and canned goods. Most store brand quality matches or exceeds national brands since they’re often manufactured in the same facilities. Compare price differences on your next shopping trip – you’ll discover incredible savings on everything from cereal to cleaning supplies.

Focus on non-perishables first, then gradually expand to other categories. You’ll build confidence in generic products while watching your grocery budget shrink. This simple swap alone can save you $50-100 monthly without sacrificing taste or nutrition!

The money you save from switching to generic brands could be redirected toward launching a small business idea that generates $15,000-$30,000 annually.

Use Coupons and Cashback Apps

Combining generic brands with strategic coupon use creates even more powerful savings opportunities for your grocery budget. You’ll maximize your purchasing power by stacking manufacturer coupons with store sales. Download apps like Ibotta, Checkout 51, and Rakuten to earn cashback on purchases you’re already making.

Don’t forget to use store loyalty programs! These programs offer exclusive discounts and personalized deals based on your shopping habits. Sign up for every grocery store you frequent – it’s free money waiting for you to claim.

Use savings apps to compare prices across multiple stores before making your purchases. Make sure you redeem points and rewards regularly before they expire. Set monthly reminders to check your accumulated benefits and convert them into savings. With consistent effort, you’ll easily save $50-100 monthly just from combining these simple strategies with your regular shopping routine.

Reduce Your Energy Bills With Simple Changes

Although energy bills can feel overwhelming, small adjustments around your home will dramatically cut your monthly costs without sacrificing comfort. You’ll maximize energy efficiency by switching to LED bulbs, which use 75% less energy than traditional incandescent bulbs. Unplug electronics when they’re not in use – these “energy vampires” can add $100 annually to your bill.

Lower your thermostat by just two degrees to save 10% on heating and cooling costs. Seal air leaks around windows and doors with inexpensive weatherstripping or caulk. You can conduct home energy audit yourself by checking for drafts and inspecting insulation.

Install a programmable thermostat to automatically adjust temperatures throughout the day and save up to 10% per year on your energy bills.

These simple changes require minimal upfront investment but deliver substantial monthly savings. You’re taking control of your expenses while creating a more comfortable living environment!

Find Free Entertainment in Your Community

When you think entertainment means spending money, you’re missing countless free activities happening right in your neighborhood. Your community offers amazing opportunities that cost nothing but deliver real fun and connection.

Your neighborhood is packed with free entertainment options that create genuine connections without emptying your wallet.

Start by checking your local library’s event calendar. Most host movie nights, book clubs, and educational workshops throughout the month.

Parks departments organize free concerts, fitness classes, and seasonal festivals that bring people together.

When you attend local community events, you’ll discover hidden gems like art gallery openings, farmers market demonstrations, and cultural celebrations. Churches and community centers frequently offer free activities regardless of membership status.

Make it your mission to participate in neighborhood activities like walking groups, volunteer opportunities, and outdoor movie screenings. You’ll save hundreds while building meaningful relationships with people who share your interests and values.

Many communities also host charity runs and walks that combine physical activity with supporting local causes while providing free entertainment for the whole family.

Shop Your Closet Before Buying New Clothes

Before you head to the mall or browse online stores, take a thorough inventory of what’s already hanging in your closet. You’ll discover forgotten gems and realize you own more than you thought! This simple step can save you $200-300 monthly on unnecessary clothing purchases.

Start by pulling everything out and organize and declutter closet space systematically:

- Try on forgotten pieces – You might rediscover favorites you haven’t worn in months

- Mix and match differently – Create fresh outfit combinations from existing items

- Repurpose versatile pieces – Transform work clothes into casual weekend wear

- Donate items that don’t fit – Don’t keep clothes hoping to wear outgrown clothes someday

This closet audit empowers you to maximize what you already own while identifying actual wardrobe gaps worth purchasing. When you do need to buy something, make shopping used items your default habit before purchasing anything new to save 50-80% compared to retail prices.

Use the 24-Hour Rule for Non-Essential Purchases

Shopping your closet builds the foundation for smarter spending habits, but what happens when you do need to buy something new? That’s where the 24-hour rule becomes your financial superpower. Before making any non-essential purchase over $25, walk away and wait a full day. This cooling-off period helps you distinguish between wants and genuine needs.

During those 24 hours, research alternatives to find better deals. Compare prices across different stores and consider online alternatives that might save you 20-40%. Ask yourself tough questions: Do I really need this? Will I use it regularly? Can I borrow it instead?

You’ll be amazed how many “must-have” items lose their appeal overnight. This simple strategy can easily save you $100+ monthly by preventing impulse purchases. Just like with habit formation, consistently practicing this 24-hour waiting period will make mindful spending feel more automatic and require less mental effort over time.

Switch to a Cheaper Cell Phone Plan

Although most people assume they’re getting a good deal on their cell phone plan, you’re likely overpaying by $30-60 every month. Major carriers often lock you into expensive contracts with features you don’t need.

Most cell phone users unknowingly overpay by $30-60 monthly due to unnecessary contract features from major carriers.

Take control by auditing your current plan and exploring better options:

- Analyze your usage – Check how much data, talk time, and texts you actually use monthly

- Consider prepaid cell phone options – These plans often cost 40-50% less than postpaid contracts

- Explore discounted family plans – Share costs with relatives or trusted friends to slash individual bills

- Research MVNOs – Smaller carriers use the same towers but charge markedly less

You’ll save $360-720 annually just by switching! Most people complete this shift in under 30 minutes online. When you cancel unused subscriptions and negotiate better rates on cell phone and internet plans, you’re taking the same approach that helps people break free from living paycheck to paycheck.

Cut the Cable and Use Streaming Services Wisely

While cable TV bills continue climbing toward $100-150 monthly, you’re probably watching just a handful of channels regularly. Here’s your chance to slash that expense and take control of your entertainment budget!

Start by canceling cable and choosing 2-3 streaming services max. Netflix, Hulu, and Amazon Prime together cost around $35 monthly – that’s $65-115 in monthly savings! Utilize free streaming trials strategically by rotating services every few months. Watch Netflix for three months, then switch to Hulu.

Explore ad-supported streaming options like Tubi, Crackle, and Pluto TV for completely free content. Your local library likely offers free streaming services too. With a decent internet connection and smart planning, you’ll access more content than cable ever provided while keeping hundreds in your pocket annually.

Refinance or Negotiate Lower Interest Rates

Beyond cutting monthly bills like cable, you can tackle larger fixed expenses that drain your budget year after year. Your loans and credit cards likely carry interest rates that cost you hundreds monthly. It’s time to reduce monthly payments by taking control of these financial burdens.

Here’s how to explore refinancing options and negotiate better rates:

- Call your credit card companies – Ask for lower interest rates based on your payment history

- Research mortgage refinancing – Even a 1% reduction saves thousands annually

- Shop around for auto loan rates – Credit unions often offer competitive terms

- Consolidate high-interest debt – Combine multiple payments into one lower rate

You’ve got the power to slash these costs! One phone call could save you $50-200 monthly. Start with your highest-interest debt first.

Sell Items You No Longer Need

Every home contains hundreds of dollars worth of forgotten treasures just waiting to be converted into cash. You’ve got the power to transform clutter into cold, hard money that’ll boost your savings account immediately.

Your forgotten clutter holds untapped wealth – turn those dusty possessions into immediate cash for your savings account today.

Start by conquering one room at a time. Hunt down items you haven’t touched in six months – clothes, books, kitchen gadgets, and decorations. Don’t forget to sell unused electronics like old phones, tablets, or gaming systems that command serious cash.

You can host a garage sale this weekend and pocket $200-500 easily. Online platforms like Facebook Marketplace and eBay expand your reach beyond neighbors. Price items at 10-20% of retail value for quick sales.

Take control of your financial future by decluttering strategically. You’ll create space while generating instant income!

Use Public Transportation or Carpool

Your car is secretly draining hundreds of dollars from your budget every month through gas, insurance, maintenance, and parking fees. Take control of your transportation costs by making smarter choices that put money back in your pocket.

When you use public transit for commuting, you’ll slash your monthly expenses by $200-400. Many cities offer discounted monthly passes that cost less than a week’s worth of gas. You can also participate in office carpooling program initiatives to share fuel costs with coworkers.

Here are four powerful ways to reduce transportation expenses:

- Buy monthly transit passes for maximum savings

- Join workplace carpool groups through company bulletin boards

- Walk or bike for trips under two miles

- Combine errands into single trips to minimize fuel usage

Maintain Your Car to Avoid Costly Repairs

While many people view car maintenance as an unnecessary expense, spending just $50-100 on regular upkeep can prevent repair bills that reach thousands of dollars. You’re fundamentally investing in your financial future by taking control of your vehicle’s health.

A $75 investment in routine maintenance today prevents a $4,000 repair disaster tomorrow—that’s smart financial planning in action.

Start by checking your oil every month and changing it according to your manual’s schedule. This simple step prevents engine damage that could cost $3,000-5,000 to repair.

Replace air filters, rotate tires, and check fluid levels regularly.

Schedule tune ups every 30,000 miles or as recommended. A $200 tune-up beats a $1,500 transmission replacement! When you perform regular maintenance, you’re making a power move that keeps money in your pocket. Your disciplined approach today saves you from financial emergencies tomorrow.

Shop at Thrift Stores and Consignment Shops

Smart shoppers have figured out that thrift stores and consignment shops offer incredible deals on quality items you’d pay full price for elsewhere. You’ll discover designer clothes, furniture, and household items at 70-90% off retail prices. These treasure hunts can save you hundreds monthly while building your power wardrobe and home.

Master these proven thrift store strategies and consignment shop techniques:

- Shop weekdays for better selection – New inventory arrives Monday through Wednesday

- Focus on quality brands – Look for designer labels and solid wood furniture

- Inspect items carefully – Check zippers, seams, and functionality before buying

- Negotiate prices – Many stores accept reasonable offers, especially on higher-priced items

You’re building wealth while looking great!

Grow Your Own Herbs and Vegetables

Growing fresh herbs and vegetables at home transforms your grocery budget while putting nutritious, flavorful food on your table. You’ll slash $30-50 monthly from produce costs by cultivating basics like basil, tomatoes, and lettuce.

Start small with a windowsill herb garden or balcony containers. You don’t need acres of land to succeed! Create vertical gardening solutions using wall-mounted planters or hanging baskets to maximize limited space. Even apartment dwellers can grow impressive harvests.

Focus on expensive grocery items first—fresh herbs cost $3-4 per package but pennies to grow. Tomatoes, peppers, and leafy greens offer excellent returns on investment.

Learn to preserve homegrown herbs by freezing them in olive oil or drying bundles. You’ll extend your harvest’s value and reduce food waste while building real self-sufficiency skills that compound your savings year-round.

Make Your Own Coffee Instead of Buying It

Although that daily coffee shop visit feels like a small expense, brewing at home delivers massive savings that’ll shock you. That $5 latte adds up to $150 monthly – money you can redirect toward your financial goals!

Take control of your coffee budget with these power moves:

- Grind your own beans for maximum freshness and flavor control

- Buy quality beans in bulk to cut costs by 60-70%

- Invest in a decent coffee maker that’ll pay for itself within weeks

- Master different brewing methods to create café-quality drinks

When you infuse at home, you’re not just saving money – you’re building wealth. Start with basic equipment and upgrade gradually. Your future self will thank you for choosing financial freedom over overpriced convenience!

Use the Library for Books, Movies, and Resources

Just like brewing coffee at home transforms your budget, your local library offers another goldmine of free entertainment and resources that most people completely overlook. You’ll save $15-30 monthly on books alone when you visit library regularly instead of buying new releases.

Your local library delivers $15-30 monthly savings on books while offering a treasure trove of overlooked free entertainment and resources.

Modern libraries aren’t just about dusty novels anymore – they’ve got DVDs, streaming services, audiobooks, and even video games you can borrow absolutely free.

Smart savers utilize library resources like computers, printers, and high-speed internet too. Why pay $50 monthly for home internet when you can work remotely from the library? Many locations offer meeting rooms, workshops, and career services that’d cost hundreds elsewhere.

Make library visits part of your weekly routine, and you’ll slash entertainment expenses while discovering resources you never knew existed!

Plan Staycations Instead of Expensive Vacations

While expensive vacations drain your bank account with $2,000-5,000 price tags, staycations deliver the same relaxation and adventure for under $200. You’ll discover local attractions you’ve overlooked and explore staycation activities that rival any distant destination.

Transform your home area into your personal vacation paradise:

- Visit nearby state parks – hiking trails and scenic views cost just $5-15 per day

- Book local museum passes – most offer family packages under $50 for weekend exploration

- Try restaurant week specials – sample upscale dining at 50% off regular prices

- Plan camping trips within 50 miles – enjoy nature without expensive flights or hotels

You’ll save thousands while supporting your local economy and reducing travel stress. Plus, you won’t waste precious vacation days on airport delays!

Buy in Bulk for Frequently Used Items

When you buy household essentials in bulk, you’ll slash your per-unit costs by 20-40% while reducing those frequent shopping trips. You’ll gain control over your budget and free up precious time for what matters most.

Start with items you use consistently every month. Buy in bulk for toiletries like toilet paper, shampoo, and toothpaste—these never expire and you’ll always require them. Buy in bulk for cleaning supplies such as laundry detergent, dish soap, and all-purpose cleaners. These staples offer the biggest savings potential.

Focus on warehouse stores like Costco or Sam’s Club for maximum discounts. Calculate the per-unit price to verify you’re getting real deals. Store everything properly to maintain quality. You’ll cut your monthly household expenses by $75-150 while eliminating those annoying mid-week store runs!

Repair Instead of Replace When Possible

Before you toss that broken appliance or worn-out item in the trash, consider the repair route that could save you hundreds of dollars annually. You’ll gain financial control while developing valuable skills that serve you for life.

Here’s your repair-first action plan:

- Learn DIY repair techniques through YouTube tutorials and online guides for common fixes

- Take advantage of extended warranties when purchasing new items to maximize protection

- Build a basic toolkit with screwdrivers, pliers, and duct tape for quick fixes

- Find local repair shops for complex issues that exceed your skill level

Start small with simple repairs like loose handles or torn clothing. You’ll discover that many “broken” items just need minor adjustments. This mindset shift transforms you from a consumer into a problem-solver, putting money back in your pocket.

Negotiate Bills With Service Providers

Just as fixing broken items saves you money, questioning your monthly bills can open even bigger savings opportunities. You hold more power than you realize when dealing with service providers. They’d rather keep you as a customer than lose you entirely.

Start by calling your internet, phone, and cable companies. Ask about current promotions or loyalty discounts. You’ll be surprised how often they’ll reduce your monthly rate just for asking. If you’ve been a good customer, mention it confidently.

Don’t stop there – negotiate late fees and negotiate service fees whenever they appear on your bills. These charges are often negotiable, especially if it’s your first offense. Insurance companies, credit card providers, and utility companies will frequently waive fees to maintain your business.

Create a Budget and Track Your Expenses

While negotiating bills puts money back in your pocket immediately, creating a budget gives you long-term control over your finances. You’ll discover exactly where your money goes and identify opportunities to save hundreds monthly.

A well-planned budget reveals hidden spending patterns and unlocks hundreds in monthly savings you never knew existed.

Start building your financial foundation with these essential steps:

- Track income patterns from all sources including salary, freelance work, and side hustles

- Monitor spending habits by reviewing three months of bank statements and credit card bills

- Categorize expenses into fixed costs like rent and variable expenses like entertainment

- Set realistic spending limits for each category based on your actual income

Use free apps like Mint or simply create a spreadsheet to track everything. You’ll quickly spot spending leaks that drain your wallet without adding value to your life.

Use the Envelope Method for Cash Spending

Once you’ve identified your spending categories, the envelope method transforms your budget from numbers on paper into real cash you can see and touch. You’ll allocate specific dollar amounts to labeled envelopes for groceries, entertainment, dining out, and other variable expenses. This powerful system forces you to track spending habits in real-time because when an envelope’s empty, you’re done spending in that category.

Start by determining weekly amounts for each envelope, then set cash withdrawal limits at your bank to match your total. For example, withdraw $200 weekly if your envelopes need $50 for groceries, $75 for gas, $50 for entertainment, and $25 for miscellaneous items. You’ll instantly see where your money goes and make conscious decisions about every purchase. This tangible approach eliminates mindless swiping!

Find Cheaper Auto and Home Insurance

Because insurance companies compete aggressively for customers, you’re likely paying more than necessary for your auto and home coverage. You can slash these monthly expenses by taking strategic action that puts money back in your pocket.

Here’s your power move strategy:

- Research bundling policies with your current provider first – many offer 10-25% discounts for combining auto and home coverage

- Compare quotes from different providers using online tools like Progressive’s comparison feature or independent agent networks

- Raise your deductibles from $500 to $1,000 to reduce premiums by 15-30%

- Ask about discounts for good driving records, security systems, or professional memberships

You’ll typically save $200-600 annually with just two hours of research. Set a calendar reminder to repeat this process every two years for maximum savings!

Reduce Water Usage to Lower Utility Bills

Your home’s water bill offers another excellent opportunity to cut monthly expenses without sacrificing comfort. You’ll discover that small changes create surprisingly significant savings each month.

Start by reducing shower duration from ten minutes to five minutes. This simple adjustment can slash your water heating costs by $200 annually. Install low-flow showerheads and faucet aerators for maximum efficiency without losing water pressure.

Next, adjust sprinkler schedules to water your lawn during early morning hours when evaporation rates stay low. You’ll use 30% less water while maintaining a healthy yard. Check for leaky faucets and running toilets immediately – these silent money drains cost you $35 monthly.

Run dishwashers and washing machines only with full loads. These strategic changes will reduce your water bill by $40-60 each month!

Shop End-of-Season Sales for Future Needs

While retailers clear their shelves each season, you’ll find incredible opportunities to stock up on items you’ll need throughout the year. You’ll dominate your budget by thinking ahead and buying strategically when prices plummet.

Strategic seasonal shopping transforms budget constraints into purchasing power when you time your buys with retailer clearance cycles.

Shop clearance sales at the end of each season to maximize your purchasing power:

- Winter gear in March – Coats, boots, and gloves drop 70-80% off retail

- Summer items in September – Pool supplies, fans, and outdoor furniture hit rock bottom

- Holiday decorations in January – Christmas items often sell for 90% off original prices

- Back-to-school supplies in October – Stock up on notebooks, pens, and backpacks

Watch for price drops during seasonal changes. You’ll build a year-round inventory while spending considerably less than full-price shoppers.

Use Social Media to Find Free Events

Social media platforms have transformed into treasure troves of free entertainment opportunities that you can discover with just a few taps on your phone. Facebook events, Instagram stories, and neighborhood groups showcase concerts, festivals, art walks, and workshops happening right in your backyard. You’ll find everything from free yoga classes to outdoor movie screenings that would’ve cost you $15-30 per person elsewhere.

Start following your city’s official pages, local libraries, museums, and community centers. They regularly post about upcoming free activities. Use social media platforms like Nextdoor and Facebook groups to discover community events your neighbors are sharing.

Set aside ten minutes weekly to scroll through these resources. You’ll uncover hidden gems like free cooking demonstrations, author readings, and seasonal celebrations that’ll keep your social calendar full without draining your wallet!

Make Homemade Gifts Instead of Store-Bought

Homemade gifts carry a personal touch that store-bought items simply can’t match, and they’ll save you serious money during gift-giving seasons. You can slash your gift budget by 70% while creating meaningful presents that recipients will treasure.

DIY craft projects don’t require expensive supplies. You’ll find most materials around your house or at dollar stores. Homemade food gifts work especially well for multiple recipients.

Here are four budget-friendly gift ideas you can master:

- Mason jar cookie mixes – Layer dry ingredients for under $3 per gift

- Photo memory books – Use free online templates and printed photos

- Herb garden starter kits – Repurpose containers with seeds and soil

- Handmade candles – Melt old candles into new containers

Start planning gifts two months ahead to avoid rushed purchases and maximize your savings potential.

Choose Generic Medications When Available

Generic medications can cut your prescription costs by up to 85% without sacrificing quality or effectiveness. You’ll maintain complete control over your healthcare spending while receiving identical active ingredients found in brand-name drugs. The FDA requires generic prescriptions to meet the same rigorous standards as their expensive counterparts.

Start conducting prescription cost comparisons at your local pharmacy or online. You’ll discover that a generic blood pressure medication costing $15 monthly versus $120 for the brand version saves you $1,260 annually! Simply ask your doctor to prescribe generics when writing new prescriptions, or request your pharmacist to substitute generics for existing medications.

Most insurance plans actually prefer generics, so you’ll often pay lower copays too. This single switch can easily save you $200-500 monthly on prescription costs.

Eliminate Impulse Purchases at Checkout

While you’re waiting in checkout lines, retailers strategically place tempting items designed to trigger last-minute spending decisions. You can avoid impulse triggers by establishing checkout policies before you shop.

Take control with these proven strategies:

- Keep your hands busy – Hold your phone or shopping list to resist grabbing candy or magazines

- Use self-checkout lanes – Skip the temptation-filled traditional checkout aisles entirely

- Set a firm “no extras” rule – Only purchase items already on your predetermined shopping list

- Calculate your total mentally – Stay focused on your budget instead of scanning nearby products

Establish checkout policies that work for your lifestyle and stick to them religiously. These small changes can save you $50-100 monthly by eliminating unnecessary purchases that add up quickly over time.

Use Cashback Credit Cards Responsibly

After you’ve mastered controlling your spending at checkout, you can actually earn money back on necessary purchases through cashback credit cards. You’re fundamentally getting paid for buying things you already need – groceries, gas, and utilities.

Getting paid for buying necessities you already need sounds too good to be true, but cashback credit cards make it reality.

Choose cards that maximize cashback benefits in categories where you spend most. Some cards offer 2% back on everything, while others provide 5% on rotating categories. You’ll want to track these quarterly changes to optimize your earnings.

The golden rule? Pay your full balance every month to avoid interest charges. Credit card interest rates often exceed 20%, which completely destroys any cashback gains you’ve earned. Set up automatic payments for the statement balance, not the minimum payment.

When used strategically, you’ll turn your regular spending into extra money that accelerates your savings goals.

Find Ways to Increase Your Income

How can you accelerate your journey to financial freedom when cutting expenses only gets you so far? The answer lies in boosting your earning potential through strategic income diversification.

You don’t need to wait for a promotion to increase your monthly cash flow. Here are four powerful ways to expand your income:

- Take on freelance work in your existing skill set – writing, design, or consulting can earn $20-50 per hour

- Explore passive income streams like dividend stocks or rental properties that generate money while you sleep

- Monetize your hobbies by selling crafts, photography, or teaching lessons online

- Start a side hustle delivering food, pet-sitting, or offering virtual services

Even an extra $300 monthly creates $3,600 annually for your financial goals!

Build an Emergency Fund to Avoid Debt

Since unexpected expenses can derail even the most careful budget, building an emergency fund becomes your financial safety net that prevents costly debt cycles. You’ll want to start small—even $25 per week adds up to $1,300 annually. This fund shields you from relying on credit cards when your car breaks down or medical bills arrive unexpectedly.

Begin by opening a separate high-yield savings account specifically for emergencies. Set up automatic transfers from your checking account, treating this like any other essential bill. Your initial goal should be $1,000, then gradually build toward three months of expenses.

When you build an emergency fund, you’re taking control of your financial future. You’ll avoid unexpected expenses derailing your progress and maintain the momentum you’ve worked hard to create.

Conclusion

You’ve got all the tools to transform your finances starting today! These 35 frugal living tips aren’t just suggestions—they’re your roadmap to saving $500 or more each month. Start small by canceling one unused subscription or cooking dinner at home tonight. Every dollar you save builds momentum toward your financial goals. Recall, frugal living isn’t about deprivation; it’s about making smart choices that’ll secure your future.

Leave a Reply