You may have told yourself you’ll start saving “someday,” but what if that day could be today? The Daily Dollar Challenge transforms the overwhelming goal of building savings into something surprisingly manageable – just one dollar per day. While $365 might not seem life-changing, this simple habit creates something far more valuable than the money itself. It builds the foundation for financial discipline that can reshape your entire relationship with money, and the best part is how easily it fits into your current routine.

How the Daily Dollar Challenge Works

The Daily Dollar Challenge is surprisingly simple: you save just one dollar every single day for an entire year. You’ll build consistent savings habits without feeling overwhelmed by large amounts. Start by finding one dollar each morning and placing it in a jar, envelope, or savings account.

This approach develops powerful financial discipline practices that’ll transform your money mindset. You’re not just saving $365 – you’re creating a foundation for bigger financial wins. The beauty lies in its simplicity: anyone can find one dollar daily. Skip that extra coffee, collect loose change, or set aside cash from small purchases.

Consider using a cash envelope system to physically separate your daily dollar from other spending money, making your savings progress more tangible and harder to accidentally spend.

Benefits of Gradual Savings Growth

Building momentum becomes your secret weapon when you save gradually over time. You’ll develop an intentional mindset that transforms small actions into powerful results. Each day builds upon the previous one, creating unstoppable forward motion toward your financial goals.

Your consistent commitment strengthens like a muscle with daily exercise. Starting with just one dollar removes intimidation and builds confidence immediately. As amounts increase gradually, you won’t feel the financial strain that derails other saving methods.

This approach rewires your brain for success. You’ll notice improved discipline spilling into other life areas. The psychological wins accumulate faster than the money itself! You’re training yourself to follow through on commitments, making you unstoppable. Just like habit formation follows the simple loop of cue, routine, and reward, your daily dollar challenge creates a powerful pattern that compounds into significant financial changes when maintained consistently.

Setting Up Your Challenge for Success

Success requires preparation, so let’s create your foolproof system before day one arrives. You’ll need three essential budgeting strategies to dominate this challenge.

First, designate a specific savings container – whether it’s a jar, envelope, or separate bank account. Second, establish your daily routine by linking savings to an existing habit like morning coffee or evening phone charging. Third, prepare backup funds for challenging days when cash feels tight.

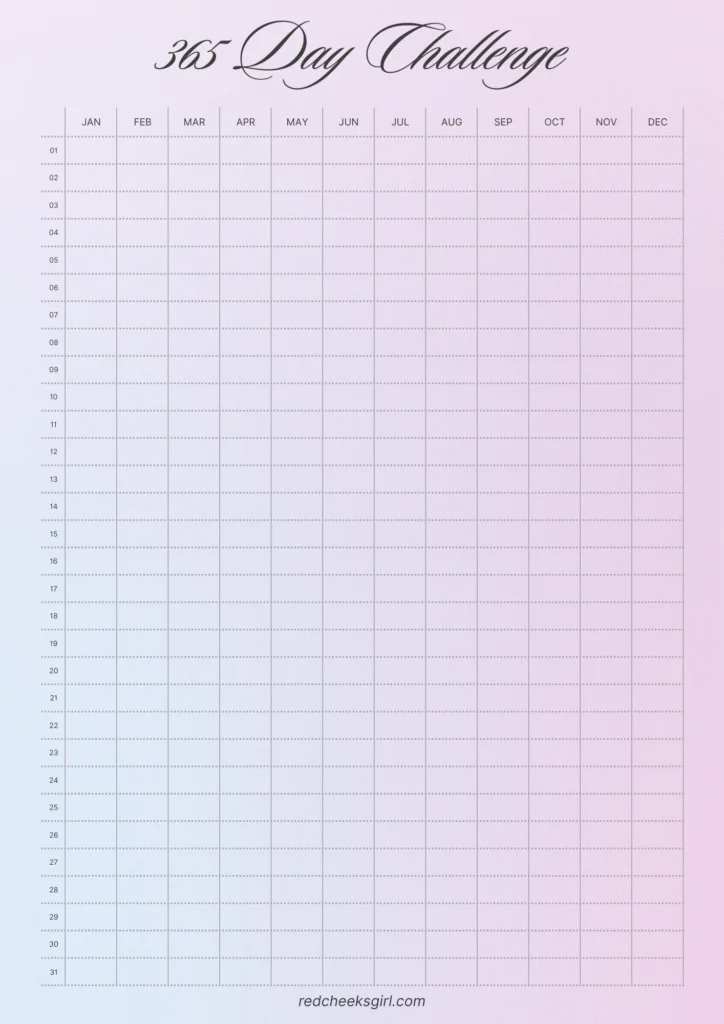

Your mindset adjustments matter just as much as logistics. View each dollar as an investment in your financial power, not a sacrifice. Create visual motivation by tracking progress on a calendar or chart. You’re building discipline that extends beyond this year-long challenge. Apply the SMART method by making your daily dollar savings specific, measurable, achievable, relevant, and time-bound to increase your success rate. Set yourself up to win by removing obstacles and creating momentum from day one!

Tracking Your Progress Throughout the Year

Once you’ve got your system in place, monitoring your daily saves becomes your next priority. You’ll want to check off each day as you complete it, creating a powerful visual reminder of your progress. Set up weekly check-ins to guarantee you’re hitting your targets consistently.

Monitoring your spending habits becomes easier when you’re actively engaged with your challenge. You’ll notice patterns in your saving behavior and identify potential roadblocks before they derail your efforts. Keep a simple calendar or use a smartphone app to track your daily contributions.

Reviewing weekly targets helps you stay accountable and maintain momentum. If you miss a day, don’t panic – simply catch up the next day or adjust your schedule. You’re building a habit that’ll serve you well beyond this year-long challenge! Consider incorporating your savings tracking into a weekly planning session where you can reflect on your progress and set intentions for the upcoming week.

Overcoming Common Obstacles and Setbacks

Every saver faces hurdles during their dollar challenge journey, but you’re not alone in this struggle. When obstacles arise, prioritizing motivation becomes your secret weapon for staying on track.

Common setbacks include forgetting daily deposits, unexpected expenses, or simply losing steam. The key is minimizing distractions that pull you away from your goal. Create simple systems that work with your lifestyle, not against it.

- Set phone reminders – Schedule daily alerts at the same time each day

- Use the “catch-up” method – Double up the next day if you miss one

- Find an accountability partner – Share your progress with someone who’ll encourage you

- Celebrate small wins – Acknowledge every $50 milestone you reach

Remember that consistent habits lead to steady progress and higher motivation, so pushing through on the difficult days will ultimately make your saving habit stronger.

What to Do With Your $365 After Completion

Completing your daily dollar challenge puts you in an exciting position with $365 burning a hole in your pocket! Now you’ll harness this momentum to build real wealth and financial power.

Smart budgeting strategies suggest treating this $365 as seed money for bigger goals. You could boost your emergency fund, giving you more control over unexpected expenses. Alternatively, explore investment options that multiply your hard-earned cash. Consider opening a high-yield savings account, purchasing index funds, or investing in a Roth IRA for tax-free growth.

Don’t just spend it on fleeting purchases! You’ve proven you can save consistently, so leverage that discipline. Use this $365 as your foundation for a $500 challenge next year, or split it between multiple financial goals. Before making your decision, rank priorities ruthlessly to ensure your $365 goes toward what matters most in your current financial situation. Your future self will thank you for choosing growth over instant gratification.

Conclusion

You’ve got everything you need to start your Daily Dollar Challenge today! Set aside just one dollar each day, and you’ll watch your savings grow to $365 by year’s end. This simple habit builds financial discipline while keeping you motivated with daily progress. Don’t wait for the perfect moment—grab a jar, mark your calendar, and begin tomorrow. Your future self will thank you for taking this manageable first step toward better savings habits!

Leave a Reply