You’ve probably wondered what separates billionaires from the rest of us—and no, it’s not just luck or family money. These ultra-successful individuals think fundamentally differently: they build systems instead of chasing goals, turn failures into million-dollar lessons, and create value before pursuing profit. While most people focus on quick wins, billionaires master strategic patience and compound tiny advantages over decades. Here’s what I’ve discovered about their counterintuitive approaches that challenge everything you think you know about wealth-building.

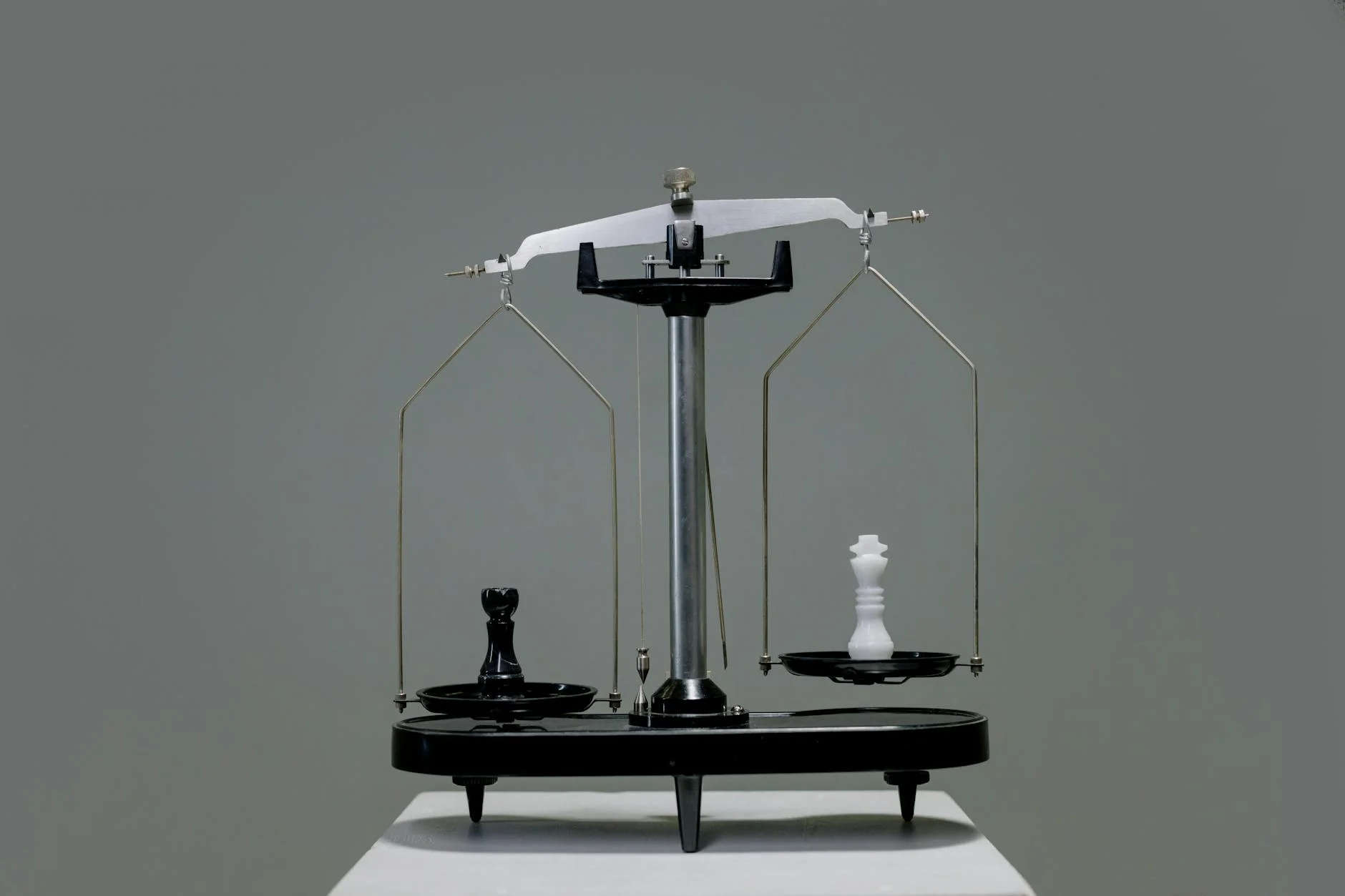

Think in Systems, Not Goals

Why do most people set ambitious goals only to abandon them within weeks, while billionaires seem to effortlessly build empire after empire? The answer lies in their fundamental approach: they don’t chase goals—they build systems.

When you focus on goals, you’re fundamentally playing a short-term game with long-term consequences. Goals have endpoints; systems create perpetual momentum.

Take Warren Buffett’s investment philosophy: he doesn’t aim to “make money this quarter”—he’s constructed a systematic approach to value investing that compounds wealth automatically.

Systems are recurring processes that produce consistent results without constant willpower. Instead of setting a goal to “network more,” create a system where you connect with three industry leaders weekly. This transforms sporadic effort into predictable power-building that operates whether you’re motivated or not.

Embrace Failure as Expensive Education

While most people treat failure like a contagious disease—something to avoid at all costs and hide when it inevitably happens—billionaires have flipped the script entirely, viewing each spectacular crash as tuition paid to the universe’s most exclusive business school.

You’ll notice that Jeff Bezos famously said Amazon’s failures are “premium-priced lessons,” and he’s right: when you’re risking millions, the education you receive from those mistakes becomes incredibly valuable. Instead of wallowing in shame—which, let’s be honest, we’ve all done after our own epic fails—you need to extract every ounce of learning from your setbacks.

Here’s the shift: start keeping a “failure resume” alongside your regular one, documenting what went wrong, why it happened, and how you’ll pivot next time.

Focus on Value Creation Over Money Making

When billionaires talk about their biggest breakthroughs, they rarely mention the moment money started flowing—instead, they obsess over the exact instant they realized they’d solved a problem that millions of people desperately needed fixed.

You’ve probably noticed this pattern: Bezos didn’t wake up dreaming of billions—he spotted the friction in book buying and said, “What if ordering books was as easy as clicking a button?” That value-first thinking separates true wealth builders from quick-cash chasers who burn out faster than a cheap candle.

Here’s what separates you from average entrepreneurs: when you focus obsessively on creating genuine value—solving real problems, eliminating pain points, making people’s lives measurably better—money becomes the natural byproduct, not the desperate goal you’re chasing with sweaty palms.

Master the Art of Strategic Patience

Once you’ve identified that million-dollar problem worth solving, the next billionaire trait kicks in—and it’s probably the hardest one for most of us to stomach: strategic patience, which means sitting on your hands while your brilliant idea marinates, develops, and slowly transforms into something that actually works at scale.

Here’s the brutal truth—while you’re itching to launch, billionaires are methodically building infrastructure, testing assumptions, and positioning themselves for massive wins down the road. Jeff Bezos didn’t expect Amazon profits for seven years; he was playing chess while competitors played checkers.

Strategic patience isn’t procrastination—it’s calculated timing that separates empire builders from flash-in-the-pan entrepreneurs who burn out chasing quick victories.

Build Networks Before You Need Them

The most successful billionaires treat networking like compound interest—they invest early, consistently, and without expecting immediate returns, because they understand that the relationships you build during your “nobody” phase often become your most valuable assets when you finally make it big.

You’re building your future board of directors, co-founders, and strategic partners right now, even if you don’t realize it. That barista you chat with? She might launch the next unicorn startup. Your college roommate studying finance could become a venture capitalist.

The key isn’t collecting business cards like Pokémon cards—it’s genuinely connecting with people before you need anything from them.

Reid Hoffman, LinkedIn’s founder, calls this “small goods”—doing small favors consistently over time. These micro-investments create relationship capital that compounds exponentially when opportunities arise.

Question Everything Others Accept as Truth

While everyone else follows the well-worn path of conventional wisdom, billionaires profit from questioning the fundamental assumptions that most people never think to challenge—and honestly, this might be the most uncomfortable habit you’ll ever develop, because it means admitting that half the “facts” you’ve built your worldview around could be completely wrong.

Start with simple questions: Why does everyone say you need a college degree to succeed? Why do people assume debt is inherently bad? Why must businesses follow traditional models? Bezos questioned why bookstores needed physical locations, Musk questioned why space travel had to be expensive, and Jobs questioned why phones needed keyboards.

You’re not being contrarian for drama—you’re mining for gold in places others won’t dig.

Invest in People, Not Just Assets

Questioning assumptions leads you to another uncomfortable truth: your network isn’t just about who you know—it’s about who you’ve invested in becoming better versions of themselves, and here’s where most people get it backwards by treating relationships like vending machines instead of gardens.

Billionaires understand that human capital—the skills, knowledge, and potential of people—appreciates faster than any stock portfolio. When you mentor someone, fund their education, or create opportunities for their growth, you’re not just being generous; you’re building compound returns through loyalty and capability.

Warren Buffett didn’t just buy companies—he invested in the people running them, often keeping existing management teams because he recognized their value. Your biggest breakthroughs won’t come from what you own, but from whom you’ve helped flourish.

Think Global While Acting Local

Once you’ve mastered investing in people, you’ll discover that billionaires possess an almost paradoxical ability to zoom out to satellite view while keeping their feet planted firmly in familiar soil—and honestly, this might be the hardest mental gymnastics trick in the entire playbook.

You’re fundamentally training your brain to operate on two frequencies simultaneously: monitoring global market shifts, currency fluctuations, and geopolitical tensions while simultaneously understanding your neighbor’s coffee preferences. Warren Buffett exemplifies this perfectly—he studies international economic indicators from his Omaha office, then invests in local businesses he can literally drive past on weekends.

This dual-perspective approach isn’t just intellectual showing off; it’s strategic survival. You’re building a mental framework that captures massive opportunities while avoiding the costly mistake of losing touch with ground-level realities that actually drive consumer behavior.

Turn Problems Into Profitable Solutions

Because the most successful billionaires treat every complaint, frustration, and societal headache as a flashing neon sign pointing directly toward their next fortune, you’ll need to completely rewire how your brain processes problems—and trust me, this mental shift feels about as natural as learning to write with your non-dominant hand while riding a unicycle.

When Sara Blakely heard women complaining about pantyhose, she didn’t just nod sympathetically; she cut the feet off her own pantyhose and built Spanx into a billion-dollar empire. That’s the billionaire playbook: listen for pain points, then engineer solutions that people will pay handsomely to obtain.

Your power lies in recognizing that every frustrated sigh represents untapped market demand waiting for someone bold enough to capitalize on it.

Leverage Time Through Delegation and Automation

After you’ve identified your next profitable solution, you’ll quickly discover that executing brilliant ideas while personally handling every tiny detail is like trying to conduct a symphony orchestra while simultaneously playing every instrument—theoretically possible, but practically insane.

Smart entrepreneurs understand that time is their most precious asset: non-renewable, non-negotiable, and absolutely finite. You can’t manufacture more hours, but you can multiply your impact through strategic delegation and intelligent automation.

Start by identifying your highest-value activities—the $1,000-per-hour tasks that only you can perform. Everything else becomes a candidate for delegation to skilled team members or automation through software solutions. This isn’t about being lazy; it’s about being strategic, focusing your energy where it creates maximum leverage and exponential returns.

Make Decisions With Incomplete Information

While most people perpetually wait for perfect information before making critical decisions—essentially waiting for a unicorn that’s both riding a rainbow and filing their taxes—successful entrepreneurs have mastered the art of making smart choices with frustratingly incomplete data.

You’ve got to embrace the 70% rule: when you have roughly 70% of the information you think you need, pull the trigger. Jeff Bezos famously calls this “disagree and commit”—making high-quality decisions quickly, even when you’re not entirely convinced. The billionaire mindset recognizes that waiting for 100% certainty means your competitors have already captured the market while you’re still researching.

Here’s the kicker: you’ll never have complete information anyway, so develop your pattern recognition skills and trust your instincts when data runs dry.

Compound Small Advantages Into Massive Wins

Smart decision-making with limited data becomes exponentially more powerful when you understand that billionaires don’t hunt for home runs—they obsessively collect singles that compound into massive victories over time.

Here’s what separates you from average thinkers: while others chase dramatic breakthroughs, you’ll systematically identify tiny edges that stack. Warren Buffett didn’t become wealthy through one spectacular investment—he consistently found undervalued companies with slight advantages that compounded over decades.

Think about Amazon’s early approach: they didn’t revolutionize everything overnight, but rather optimized small elements like shipping speed, customer service response times, and inventory management. Each marginal improvement created competitive moats that became insurmountable over time.

Your mission isn’t finding the next unicorn—it’s recognizing how 1% improvements in multiple areas create exponential results through mathematical compounding.

Conclusion

You’ve got the blueprint now—think systems over goals, embrace those expensive failures, and recollect that patience isn’t just waiting around doing nothing. Start building your network today, automate what you can, and don’t wait for perfect information to make moves. These billionaire mindsets aren’t magic tricks; they’re learnable habits that compound over time. Pick one secret, implement it this week, and watch how small advantages snowball into something extraordinary.

Leave a Reply